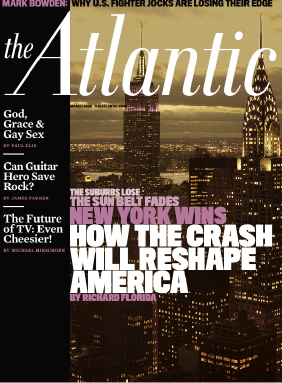

The March issue of The Atlantic Monthly included an article titled, “How the Crash Will Reshape America.” I agreed with much of this article especially the author’s conclusions that suburban American must undergo drastic changes if we are to successfully move into the future economically. But one main conclusion of the article caught me short. The Author argues that America should strive to be a society of renters and leasers, rather than home owners.

I have to admit that I can see the reasoning behind this argument. 2007 resulted in the highest percentage of home owners in America ever, and look at how that turned out. Granted. But is the appropriate conclusion that we should rent or lease rather than tie down our excess wealth in home ownership? En mass would this sort of strategy effect other aspects of our society? Are there secondary effects that home ownership has on our economy? As a primary effect individuals have less time and money to use directly in the economy if they are putting it into their homes. As a primary effect they are less flexible to pick up and move to follow a job.

At the same time it could be true that home owners have increased stability and influence in the community. What secondary effects do more stable communities have on our economy? Is it the healthiest choice for the economy long-term for our families to continue to uproot to follow jobs? Is it time for us to stop chasing home ownership as a part of the American Dream? Or have we yet to envision it properly? I dream of an ownership society that grows us wealthier and healthier.

Besides, I still can’t let go of this gut feeling that something about home ownership, when held loosely, brings with it something dignifying and empowering.

There are a couple of flaws in Richard Florida’s thinking if you ask me (and your not, so I’ll keep it short). The first problem with a society of renters and leasers is that SOMEONE has to own these properties and its going to be those who can afford to own many, many properties. So, in other-words, the divide between the “haves” and “have nots” will broaden and the next time there is an economic crisis (and FYI there will be another one someday) the consequences will be harsher for those without. The second issue is his statistics on how many people are “picking up and moving to follow a job”. Yes, we are a very mobile society (especially compared to previous generations) but a lot of times these “moves” are more akin to “upgrades”. In other-words, I’m not moving out of my house because of my job, but because I want a bigger house.

Personally, I think home ownership should be the de-facto standard. Renting only for short periods of time; maybe for less than a year. How? Simple, how about mortgages that have 60 or maybe even 90 year payback schedules?

THanks for the comment, Bob. Interesting idea on the payback schedules. I wonder if that would mean we would have to build houses to last longer as well.